For investors who don’t need to hide assets and income, bearer bonds now have few advantages. Natural disasters and fires can also cause significant losses. As a result, it’s wise to store bearer bonds in safe deposit boxes and other secure, protected locations. However, the US market has now stopped facilitating such bonds’ deals.

Security Issues With Bearer Bonds

The lack of registration means that if the bond is lost or stolen, the rightful owner has little recourse to reclaim their investment. The decline in liquidity was also exacerbated by the shift towards more transparent and secure financial instruments. Registered bonds, for instance, offer a clear record of ownership and are easier to trade on modern electronic platforms.

Are You Retirement Ready?

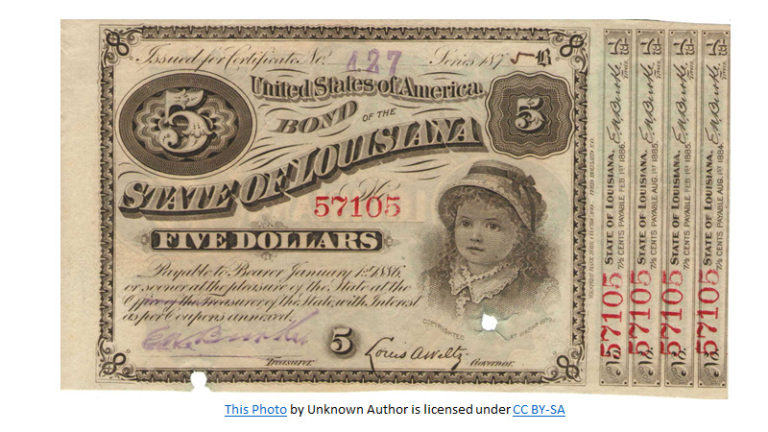

Bearer bonds are a unique type of fixed-income security that differ significantly from other bond varieties. Unlike registered bonds, which have their ownership recorded, bearer bonds belong to whoever physically holds them. These bonds come with coupons for interest payments, which must be presented at a bank or government treasury to collect.

How to Find the Market Value for CUSIP Bonds

Coupon bonds are rare since most modern bonds are not issued in certificate or coupon form. Instead, bonds are formed electronically, though some holders still prefer to own paper certificates. For this reason, the coupon bond simply refers to the rate it projects rather than its physical nature in the form of certificates or coupons. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in our SEC filings. Moreover, when someone sells a registered bond in the secondary market, the listed owner is updated and the new owner receives the rights to the bond’s cash flows.

What Is a Modern Example of a Bearer Security?

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

- Plus, modern bearer bonds issued by developed nations can have less favorable terms than registered bonds.

- This conversion process would involve reissuing the bond in the new owner’s name and recording ownership through a registered system, providing a more secure and transparent ownership transfer method.

- A bearer form may be exchanged informally in a private transaction.

- Tax evasion is one of the most significant risks, as individuals can use these bonds to hide income and assets from tax authorities.

- Bearer bonds pay interest periodically, typically semiannually, which provides bondholders with a steady income stream.

In 2010, U.S. law relieved banks and brokerages of the responsibility to honor bearer bond coupon payments and redemptions. If you find a corporate bearer bond, you can check to see if the company still exists or was taken over by another entity. By contacting the surviving company, you may be able to cash in the outstanding coupons and principal. To streamline the process, consult with a fiduciary financial advisor.

The bearer of the bond certificate is presumed to be the owner and collects interest by clipping and depositing coupons semi-annually. A bearer form is a stock or bond certificate that is not registered in the issuing corporation’s books but is payable to the person possessing it. Thus, one bearer bonds value must only possess (bear) the instrument as proof of rightful ownership. Bearer bonds come in various forms, each with distinct characteristics and uses. The primary types include corporate, government, and municipal bearer bonds, each serving different segments of the financial market.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Bearer bonds can offer portfolio diversification by providing exposure to different issuers, sectors, and geographical regions, potentially reducing overall portfolio risk. Contact the company that issued the bond if it is still in business. Provide it with the serial number on the bond, and the company should be able to tell you the redemption value of your bond. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018.

These features have made registered bonds more attractive to both investors and financial institutions, further reducing the demand for bearer bonds. The lack of a secondary market for bearer bonds has also contributed to their diminished liquidity. Without a robust market where these bonds can be easily bought and sold, their attractiveness as a liquid asset has significantly declined. Collecting the cash flows from instruments issued by corporations is not as easy and far from guaranteed.