Of course, the smallest of Oregon businesses are exempt from the CAT, other than a $250 minimum payment, but most business activity—and most employment—in Oregon comes from businesses with well over $1 million in gross revenue. In all aggregate rate calculations that include the CAT in this publication, we will use the estimate of a 6.72 percent net income equivalent. Metro-area individuals and businesses face a dizzying array of taxes on income—nine in all, not counting a Clean Energy Surcharge described later. While no category of income has all nine taxes imposed on it, every taxpayer faces several layers. In 2020, Multnomah County voters approved a measure to establish a tuition-free preschool program.

- The City of Portland’s business license tax operates similarly to Multnomah County’s business income tax, likewise levied on the net income of partnerships, S corporations, and C corporations.

- If you receive a U.S. government pension for service before October 1991, you may be entitled tosubtract all or part of that pension on your Oregon return.

- Metro-area individuals and businesses face a dizzying array of taxes on income—nine in all, not counting a Clean Energy Surcharge described later.

- A distinct artistic atmosphere, unparalleled natural amenities, and world-class attractions are enough to convince many active adults to make the move.

- 2 There is also a somewhat similar tax in Nevada, but it is levied at the entity level, has a per-employee cap, and is in lieu of an individual income tax.

- The Revenue Division may also begin collection activity for the balance due for your account.

- Effective January 1, 2022, all employers must comply with the withholding requirements.

Sales Taxes

However, an employer must offer in writing to withhold the Multnomah County PFA personal income tax from employees’ wages as soon as the employer’s payroll system(s) are able to process withholding. Multnomah County understands the challenge of this transition and will not assess penalties if the withholding is not available in 2021. However, an employer must offer in writing to withhold the Metro personal income tax from employees’ wages as soon as the employer’s payroll system(s) are able to process withholding. Metro understands the challenge of this transition and will not assess penalties if the withholding is not available in 2021. In 2020, Portland became the city with the highest personal income taxes in the United States. If a taxfiler has requested an extension to file with the IRS or State of Oregon, they must attach their federal/state extension to their Business Tax Return when they file and check the “Federal Extension” box.

State Individual Income Tax Rates and Brackets, 2024

The Revenue Division will send them a notice requesting them to file a return. If the taxfiler does not file their Business Tax Return, Civil Penalties will be assessed and collection activities will begin. Visit our eFile vendor page to see if your software provider allows the option for electronic filing. Taxfilers who qualify for an exemption from the City of Portland and/or Multnomah County Business Income Taxes must still file a Business Tax Return with their supporting tax pages. That concept is unlikely to gain much traction in Salem, if for no other reason than Gov. Tina Kotek in December made a three-year moratorium on new taxes part of her plan to revitalize Portland. The new code provisions address many procedural and substantive tax issues that had been left open by the ballot measures.

How Your Oregon Paycheck Works

- If you were a Metro resident for only a portion of the year or if you were not a resident of Metro during the year but you earned income in Metro or received income from Metro sources, you are required to complete Form MET-40-NP Non-Resident/Part Year Resident.

- It’s also worth noting that the IRS made major revisions to the W-4 in recent years.

- If you did not satisfy either requirement, you will be charged an underpayment penalty of 5% of the unpaid tax, but not less than $5.

- Oregon assesses income tax at rates up to 9.9%, and doesn’t have a general sales tax.

- With more free time, homeowners can spend time on the water at the community’s pool or down the street at scenic Oswego Lake.

- Due to high volumes of mail, returns filed in March/April and September/October may require additional time for a refund to be issued.

Oregon utilizes a graduated income tax system that starts at 4.75% for income below $3,750 and grows in different brackets until it reaches 9.90% for incomes $125,000 and above. Oregon does not tax inheritance, but an estate tax applies to estates worth $1 million and above. However, residents of the area tend to agree on a few of the features that characterize life in Portland. Located on the scenic Columbia River along the Washington border, the city of Portland, Oregon is a unique and desirable retirement destination in the Pacific Northwest. ”, we’ve created a guide exploring the aspects of the city most relevant to active adults and their preferences.

Personal Income Tax Codes, Administrative Rules, and Policies

The mayor then appoints a city administrator responsible for setting and implementing city budgets. Gonzalez’s latest copaganda techniques include calling the nonprofit grassroots organization Portland Copwatch “extreme” for wanting basic background checks for Portland Police rehires. In June, he called to limit or ban antipolice public comments during City Council meetings. Sign up for Prism’s newsletter to get first access to news and analysis that makes you think—and act.

You can drop off your tax form and make non-cash payments in person at our main office in Salem or at one of our regional field offices in Bend, Eugene, Gresham, Medford, or Portland. Part-year residents figure Oregon estimated tax the same way as a nonresident for the part of the year that they’re a nonresident, and the same way as a full-year resident for the part of the year that they’re a resident. Raising the combined US corporate rate to the second highest in the OECD would encourage corporations to depart from the US, reducing economic output and worker wages across the income spectrum. Graduated corporate rates are inequitable—that is, the size of a corporation bears no necessary relation to the income levels of the owners.

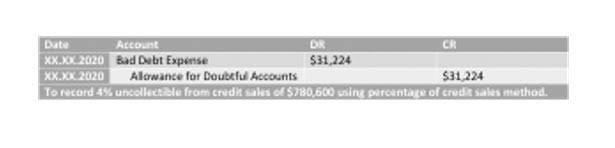

When calculating personal income taxes, Oregon relies heavily on the federal income tax structure. Oregon taxable income is equal to federal taxable income, with a limited number of additions and subtractions. The most common additions are for income taxes paid to Online Accounting other states and interest income from the government bonds of other states. In other words, single-member LLCs that are disregarded for federal income tax purposes would not file a City/County business income tax return at the LLC level.

- Revenue is distributed within the portions of Clackamas, Multnomah and Washington counties that are inside Metro’s district.

- To determine if your address is located in the Multnomah County tax jurisdiction, search your address in Portland Maps.

- This extension should be accompanied by a payment of the estimated tax due, if applicable.

- The cold months from November to February see daily temperature averages below 52 degrees, while the hot months from June to September have highs most often above 76 degrees.

- Businesses that are operating within the City of Portland and/or Multnomah County (including rideshare drivers) must register for a Revenue Division tax account within 60 days.

- On the southeast side of Portland, residents can find Kaiser Permanente Sunnyside Medical Center.

To determine if your address is located in the https://x.com/bookstimeinc Multnomah County tax jurisdiction, search your address in Portland Maps. If the search results indicate a jurisdiction of Multnomah County, your address is within Multnomah County’s jurisdiction. The U.S. imposes a progressive income tax where rates increase with income.

Oregon Property Tax

In LA, California Gov. Gavin Newsom oregon state income tax was photographed clearing out the belongings of people living in an encampment. In New York City, despite a drop in most violent crimes, the police budget for the last fiscal year was $10.8 billion. If you purchase a product or register for an account through a link on our site, we may receive compensation.